|

October 4, 2005

Schiff Criminal Tax Trial Fireworks Continue

Government’s Case Sputtering

Schiff Facing Jail For Contempt

The criminal tax trial of

Irwin Schiff entered its fourth week Monday with a cantankerous Schiff

apparently making significant headway in repelling the government’s

prosecution witnesses who have testified thus far.

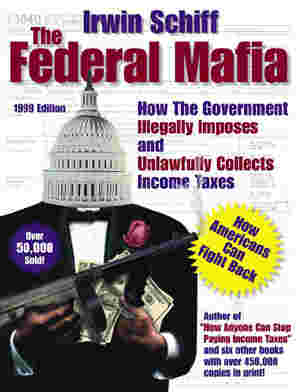

Schiff and his former co-workers, Cindy Neun and Larry Cohen, are defending

against a plethora of criminal charges in Las Vegas stemming from consulting

activities related to Schiff’s best-selling book, “The Federal Mafia: How

the Government Illegally Imposes and Unlawfully Collects Income Taxes".

|

|

The

book, which contains a detailed analysis of the Internal Revenue Code

and relevant Supreme Court decisions, was banned last year by a federal

judge.

In the Federal Mafia, Schiff details how anyone can file a

legitimate income tax return, claiming their income as “zero” because

the Supreme Court has repeatedly, and consistently, defined the legal

term “income” as meaning a “corporate profit or gain”.

Schiff, who

is arguably the leading expert and most troublesome public opponent of

the 54,000 page Internal Revenue Code, has articulated in his speeches,

written works and court filings that with regard to income taxes, the

IRS has no legal jurisdiction over ordinary Americans and that there is

no law actually imposing income taxes upon any individual. During the

trial so far, no witness for the government has been able to cite the

law actually imposing the liability for the tax. |

Over

the last three weeks, Schiff, who is defending himself with only

court-appointed stand-by counsel, has repeatedly irked the court by his

persistence in continuing to discuss specific aspects of US tax law, even

though the court has forbidden Schiff to do so, claiming it alone, will

instruct the jury as to the law.

Schiff’s rabid questioning of IRS witnesses and the continued objections of

both the DOJ and the Court, which seek to suppress any discussion about the

law, are apparently being noticed by the jury. At one point during

testimony last week, the jury, in a highly unusual act, catching the judge

and all the attorneys by surprise, submitted several written questions to

the court, one of which the judge refused to read in open proceedings.

As of last Friday, Schiff has now been ordered to serve eight days for

contempt of court for discussing the law, which USDC Judge Kent Dawson

threatens to double for each infraction Schiff commits.

Despite the substantial handicap of being prohibited from rigorously

cross-examining the government’s witnesses about the federal laws he and the

co-defendants have been accused of violating, Schiff has repeatedly

succeeded in forcing many of the government’s witnesses into admitting

important facts and legal issues in favor of the defendants. According to

Schiff, the government has yet to produce a single document into evidence

establishing that the Defendants’ tax advice was false or fraudulent.

On Monday, Schiff moved to strike the testimony of all government witnesses

to date, asserting that the Court was directly violating the Supreme Court

ruling in

Cheek v. US, 498 U.S. 192 (1991). In Cheek, the Supreme Court

specifically held that it was the burden of the government (not the

court), to establish the specific laws and legal duties that the Defendants

are accused of violating.

Schiff stated for the record that for the jury to hear the law from only the

“bench” was to effectively deny Schiff any opportunity to confront or

cross-examine his accusers about the content or application of the law. The

DOJ attorney openly stated that the government had no intention of providing

a witness to testify about the law, and that it was relying on the Court to

establish the law for the jury. The Court denied Schiff’s motion.

Also on Monday, the U.S. Attorney requested that the judge issue a special

instruction to the jury to clarify potential “confusion” that may have

arisen during the testimony of government witnesses regarding the liability

statutes that allegedly impose income taxes on wages and salaries. Such

instructions are usually given only just before the jury begins its

deliberations.

Schiff vehemently objected, noting for the record that the terms “wages” and

“salaries” had been specifically deleted from the 1954 tax code, that the

proposed instruction was contrary to legislative intent as evidenced by both

House and Senate committee reports, and that the proposed instruction was a

deliberate misstatement of the text of the current statutes. Schiff further

asserted that if the judge proceeded with giving a knowingly false jury

instruction, that he was guilty of conspiring with the government to deny

him a fair trial.

Despite Schiff’s objections, the Court issued the instruction to the jury.

The final government witnesses are scheduled to testify this week, including

two IRS CID agents that Schiff has been denied from examining under oath

during IRS’s several-year long civil prosecution of him. The defense case

follows, beginning either late this week or early next week.

Schiff

again urges everyone to read his Motions to Dismiss, which succinctly detail

the lack of jurisdiction and legal authority to impose or enforce the

federal income tax on individuals. See Schiff’s website,

www.PayNoIncomeTax.com or the previous

WTP

update about Schiff to access these compelling court documents.

Irwin Schiff |

|

Everyone is urged to

support Irwin, Cindy and Larry and attend the final days of this very

important trial that is continuing at the federal courthouse in Las

Vegas, Nevada.

Although banned for sale by Schiff, copies of Irwin’s book, The

Federal Mafia are available on

e-Bay. Schiff, an economist by profession, continues to

sell other educational products at his

website.

You can listen to free audio interviews created by Schiff supporters at

two “blogging” websites,

http://triallogs.blogspot.com/ and

http://irwinschiff.blogspot.com |

Sign outside Schiff's Las Vegas office building

Please make a

donation

to help fund the landmark Right-to-Petition lawsuit

and the ongoing operations of the We The People Foundation.

Please note:

The Foundation

currently has an outstanding balance due of approximately

$83,000

for the legal services of attorney Mark Lane. In addition, the

Foundation incurs

a significant level of regular operating, technology

and program related

costs.

It is only your generous

support

that keeps us moving forward.

Click Here to apply to become a Plaintiff and to

access the

Lawsuit Information Center which includes scholarly research on

the

Right to Petition and other lawsuit related materials, court documents,

and

the latest news.

|